Dogecoin (DOGE), the world’s hottest memecoin, has formally dipped into an oversold territory as current market efficiency signifies rising issues in regards to the fading power of the memecoin sector.

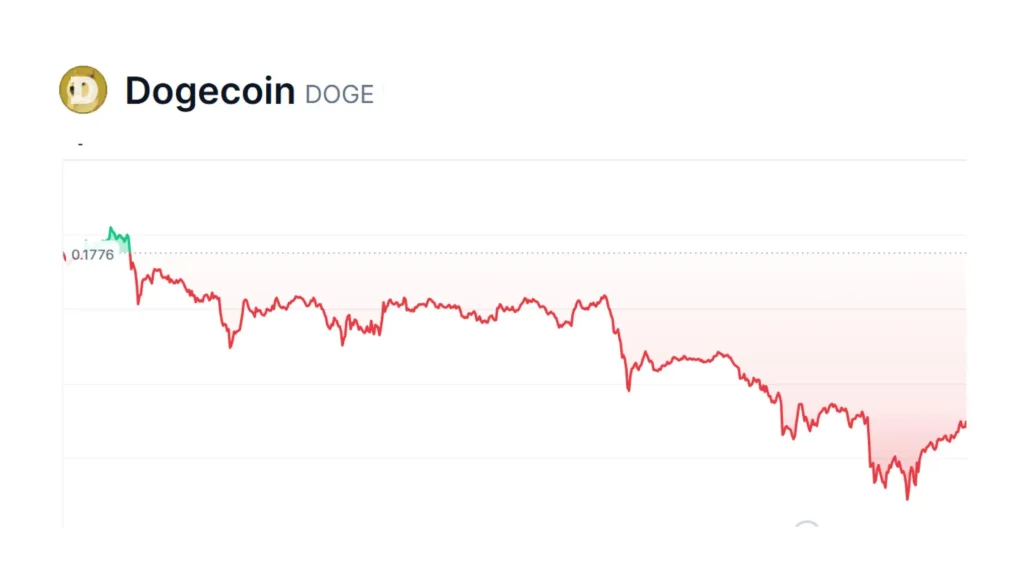

Over the previous 24 hours, the value of DOGE has plunged by about 4%, pushing it beneath $0.16 for the primary time since April. The memecoin breached a number of help ranges, together with $0.21 and $0.18, prior to now two days, and has been surpassed by Tron (TRX) within the crypto market cap rankings. Over the previous 30 days, DOGE has misplaced almost 36% of its worth.

Bulls Chorus from DOGE as Memecoin Demand Continues to Decline

The memecoin’s day by day Relative Power Index (RSI) is at present at 29.36, indicative of an “oversold” stage the place buyers typically have a tendency to purchase at lowered costs. Nonetheless, in contrast to in March, when an analogous RSI later triggered an 18% surge in value, this time round, DOGE bulls are nowhere to be discovered.

At press time, DOGE is buying and selling at $0.1544 and is at present beneath its day by day low from Sunday, June 22, 2025. In accordance with technical indicators, there aren’t any indicators of potential reversal but. The final time the token’s RSI dipped beneath 30, its value hit a flooring close to $0.12 earlier than recovering. Then, there was a supportive RSI divergence adopted by a considerable improve in buying and selling quantity. Evaluate that to present circumstances, and there’s neither, with the quantity remaining the identical whereas the value continues to fall.

One other concern for DOGE is the shortage of any vital help breakout. In March, the RSI’s push from the ground lined up with consolidation candles and a bullish RSI cross sample on the value chart. Nonetheless, this time round, the RSI sign line (Purple) continues to be dominant, and the downward slope doesn’t appear like it has flattened.

On the larger image, DOGE has been on a sluggish downward pattern since early June, dropping over 40% from its 2025 excessive above $0.26. Brief-term value bounces haven’t lasted, and each help stage the memecoin examined ultimately broke. Until this sample adjustments, the “oversold” situation could also be simply one other sign that can be ignored by a market that also isn’t satisfied by its prospects.

The newest value correction will not be particular to Dogecoin however is reflective of a broader decline throughout the altcoin market. Bitcoin’s (BTC) sideways buying and selling close to the $104,000 to $106,000 vary over the previous month has weighed closely on altcoins. Fading investor curiosity in memecoins has additionally performed a task within the decline, with Shiba Inu (SHIB) and PEPE down round 30% over the previous month.

What’s Subsequent for Dogecoin (DOGE)?

Now that DOGE is as soon as once more buying and selling beneath the $0.16 mark, the outlook for the memecoin is popping more and more bearish. Distinguished dealer and crypto analyst Ali Martinez reiterated in an X put up how essential the value vary between $0.16 and $0.22 is for the ninth largest cryptocurrency. The analyst famous {that a} day by day shut exterior this value vary would sign the subsequent main transfer, both upward or downward, by as a lot as 60%.

In accordance with Martinez, that sign is now trending downward and will pave the way in which for a pointy 60% value correction if promoting strain rises. From a technical perspective, this is able to end in DOGE aiming for a value as little as $0.088, a stage not seen for the reason that early levels of its rally in August 2021.

The following help stage for DOGE sits round $0.13, and until it will probably get better quickly above $0.16 within the coming days, then its value could also be heading towards a a lot deeper retracement, one that might finally outline Dogecoin’s place within the present market cycle.

There’s hope on the horizon, with purposes for spot Dogecoin ETFs at present underneath overview on the US Securities and Change Fee (SEC), however its prospects are but to offset DOGE’s bearish value motion. In accordance with Bloomberg senior ETF analyst James Seyffart, the likelihood of the SEC approving a Dogecoin ETF is now about 90%, with solely related merchandise based mostly on Litecoin (LTC), Solana (SOL), and XRP having a better probability of approval at 95%.

To sum it up, DOGE is technically in an oversold place, however the market isn’t responding in the way in which that bulls hoped it will. We should watch for stronger reversal alerts, reminiscent of a spike in buying and selling quantity or a break within the downward momentum, to ensure that this can be a mere value correction earlier than an enormous surge for the memecoin.