The crypto ETF market got here alive on Thursday as each the Bitcoin (BTC) and Ether (ETH) spot funds delivered spectacular performances, marking the second-largest every day inflows since their inception.

The 12 US spot Bitcoin exchange-traded funds, which debuted in January 2024, noticed an influx of $1.17 billion as their underlying asset hit a peak of $113,800 when markets closed on July 10. Bitcoin continues to surge in value, rising by 6% in lower than 24 hours to set an all-time excessive at $118,403.

The spot Ethereum ETFs additionally had a record-setting day, witnessing their second-highest influx day thus far. This was marked by ETH’s run to $3,000 following weeks of constructive momentum for the most important cryptocurrency after Bitcoin.

Spot Bitcoin ETFs See $1.17 Billion In Internet Inflows, Second-Largest Since Debut

In response to information from Farside Traders, BlackRock’s iShares Bitcoin Belief (IBIT) topped the every day influx chart with $448 million, adopted by Constancy Sensible Origin Bitcoin ETF (FBTC) with $324 million, and Ark 21Shares Bitcoin ETF (ARKB) at $268.7 million. That is the sixth consecutive day of features for the funds that present buyers with publicity to the flagship cryptocurrency’s spot market efficiency.

There have been smaller contributions from Bitwise’s BITB with $77.2 million, Grayscale’s Bitcoin Mini Belief (BTC) with $81.9 million, and $15.2 million from VanEck’s HODL. Solely the Grayscale Bitcoin Belief ETF (GBTC) skilled outflows yesterday, which amounted to $40.1 million. The full buying and selling quantity for the day was $51.3 billion, driving internet belongings underneath the ETFs to a file $139.39 billion.

The $1.17 billion every day influx is just topped by the $1.37 billion recorded for the spot Bitcoin ETFs on November 7, the day Donald Trump was declared the winner of the 2024 US Presidential race.

Spot Ethereum ETFs Amass $380 Million in Day by day Inflows, Led by BlackRock’s ETHA

In the meantime, US spot Ether ETFs buying and selling additionally witnessed constructive flows on Thursday, netting $383.1 million with none outflows. This additionally marked the second-highest internet influx for the funds since their launch in July 2024.

Unsurprisingly, BlackRock’s iShares Ethereum ETF (ETHA) dominated the inflow, registering $300 million in internet inflows. This was the fund’s highest every day influx on file. Constancy’s FETH got here in a distant second with $37.3 million, adopted by Garyscale’s Ethereum Mini Belief (ETH) with $20.7 million, and the Grayscale Ethereum Belief (ETHE) at $18.9 million.

Buying and selling volumes shattered the earlier information at $5.1 billion, and internet belongings underneath administration for the spot Ethereum ETFs rose to $11.84 billion.

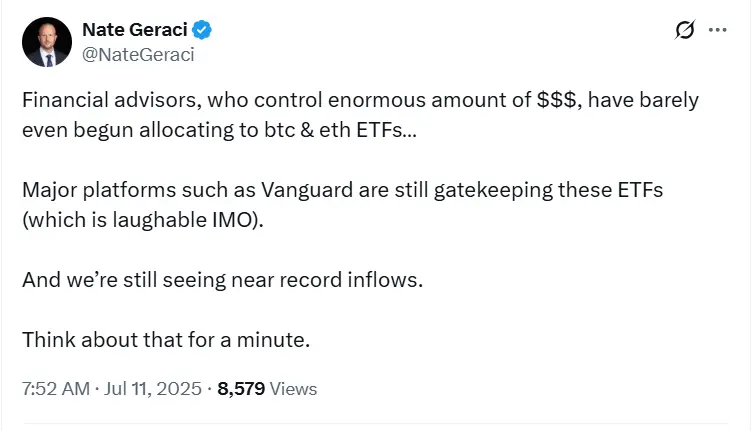

Nate Geraci, president of NovaDius Wealth Administration, took a shot at conventional monetary advisors in an X put up, saying that regardless of controlling monumental quantities of wealth, they’ve barely even begun allocating to Bitcoin and Ether ETFs, which proceed to see near-record inflows. He known as asset administration big Vanguard’s resolution to gatekeep the devices from prospects “laughable”.

Additionally Learn: Ether Follows Bitcoin’s $118K ATH By Rallying To $3,000 Amid Company Treasury Bulletins

Bitcoin and Ether ETF Demand is Outweighing the Cryptos’ Day by day Provide

Each the Bitcoin and Ether spot ETFs are absorbing the web issuance of their underlying crypto.

In response to information sourced by Extremely Sound Cash, the 24-hour internet issuance of Ether stood at 2,045 ETH, price roughly $6.20 million. This determine far exceeds Thursday’s internet influx into the spot Ethereum ETFs, which stood at $383.1 million, equal to 126,636 cash. At the moment, there are 120.89 million ETH in circulation.

Equally, yesterday, 450 BTC price $53.40 million have been mined, however the influx into the Bitcoin ETFs was price 11,550 BTC, far outweighing the provision. A latest report by Galaxy Analysis confirmed that US Bitcoin ETFs and Michael Saylor’s agency, Technique, have collectively amassed $28.22 billion in BTC, which is 4 occasions the miners’ internet issuance of $7.85 billion throughout the identical interval.

Potential Fed Fee Cuts and US Crypto Insurance policies Anticipated to Drive Demand for Bitcoin and Ether by way of ETFs

Presto Analysis analyst Min Jung famous that whereas potential US tariff dangers proceed to loom over the market, constructive catalysts just like the expectation of an rate of interest reduce by the Federal Reserve and elevated institutional urge for food for digital belongings will proceed to drive progress within the crypto house. He believes that demand for Bitcoin and Ether spot ETFs might stay “strong” within the medium time period, particularly because the belongings’ position in diversified portfolios evolves.

Traders are additionally intently watching latest regulatory developments, such because the upcoming GENIUS stablecoin act and the elimination of a key IRS crypto dealer tax rule. LVRG Analysis director Nick Ruck mentioned the developments surrounding these occasions have fueled institutional demand for main cryptocurrencies as expensive boundaries and authorized problems are being faraway from conventional monetary techniques.

On the time of writing, Bitcoin (BTC) is buying and selling at $118,372, up 6.56% within the final 24 hours. In the meantime, Ether (ETH) is altering palms at $3,007, up 8.29% since yesterday.