24 Nov Bitfinex Alpha | BTC Flooring Stays Elusive

in Bitfinex Alpha

Subscribe

to Bitfinex Alpha!

Need to obtain Alpha from Bitfinex each week?

Subscribe

Bitcoin has formally logged its fourth consecutive weekly decline, a uncommon sequence not seen in over 500 days, and this time, the pullback is each steeper and extra telling. Over the previous month, BTC has dropped 30.6 %, outpacing the 24 % drawdown seen throughout its 2024 consolidation part and lengthening the autumn from the all-time excessive to almost 36 %.

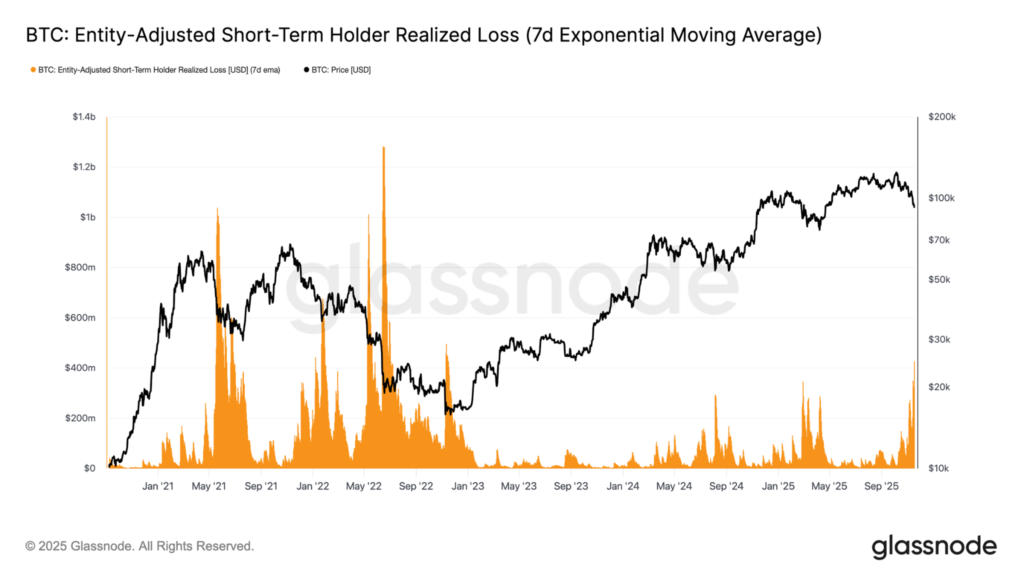

This downturn isn’t simply seen on the chart; it’s embedded in on-chain behaviour. Quick-term holders, usually probably the most delicate cohort to volatility, are capitulating at a few of the quickest charges because the FTX collapse in 2022. Realised losses for these latest patrons have surged to $523 million per day, underscoring how top-heavy the market had turn out to be within the $106K–$118K vary.

The broader market dynamics are equally putting. Bitcoin as soon as once more topped out earlier than equities, a sample noticed earlier in 2025, and might be a sign that conventional markets nonetheless have room to right. In crypto derivatives markets, losses are nonetheless being keenly felt. Following the $19.2 billion of losses seen on October tenth, there was one other $3.9bn final week. The size of deleveraging highlights the deep stress radiating by means of futures and perpetual markets.

Seasonality, normally a dependable indicator, has provided no assist. November is at present monitoring at –21.3 %, regardless of a decade-long historical past of averaging +40 % positive aspects, and October logged its first detrimental shut in seven years.

In the meantime, the US financial panorama final week mirrored an image of moderation reasonably than momentum, marked by steady, however clearly cooling, labour circumstances, cautious shoppers, and chronic weak spot in housing.

The long-delayed September jobs report confirmed stronger-than-expected payroll positive aspects alongside a slight rise in unemployment, reinforcing the view that the labour market is slowing in a managed method. With no contemporary inflation knowledge obtainable forward of the December 9–10 FOMC assembly, these figures strengthen the case for the Federal Reserve to carry rates of interest regular. On the similar time, shopper sentiment weakened notably in November, revealing rising pressure from tighter credit score and decreased buying energy, whereas dovish remarks from New York Fed President John Williams briefly boosted market expectations for a December fee lower regardless of the shortage of recent knowledge.

Housing indicators, nevertheless, stay firmly pessimistic: builder confidence stayed in contraction territory for a nineteenth consecutive month, purchaser site visitors remained weak, and worth incentives intensified as affordability worsened. General, the financial system continues to chill step by step below elevated borrowing prices, with coverage uncertainty and fragile sentiment pointing to a difficult path forward for each shoppers and the housing market.

The previous week in crypto noticed significant strikes throughout regulation, sovereign adoption, and company technique. Within the US, the White Home superior its evaluation of an IRS proposal to hitch the OECD’s world Crypto-Asset Reporting Framework, signalling a push towards larger oversight of Individuals’ offshore holdings. In the meantime, El Salvador made headlines with a historic one-day buy of 1,090 BTC, about US$100 million, deepening its long-term accumulation technique regardless of controversy over its IMF mortgage commitments. Collectively, these developments underscore how regulatory convergence, sovereign positioning, and institutional restructuring proceed to form the evolving crypto panorama.