10 Nov Bitfinex Alpha | Market Consolidating, not Cascading

in Bitfinex Alpha

Subscribe

to Bitfinex Alpha!

Need to obtain Alpha from Bitfinex each week?

Subscribe

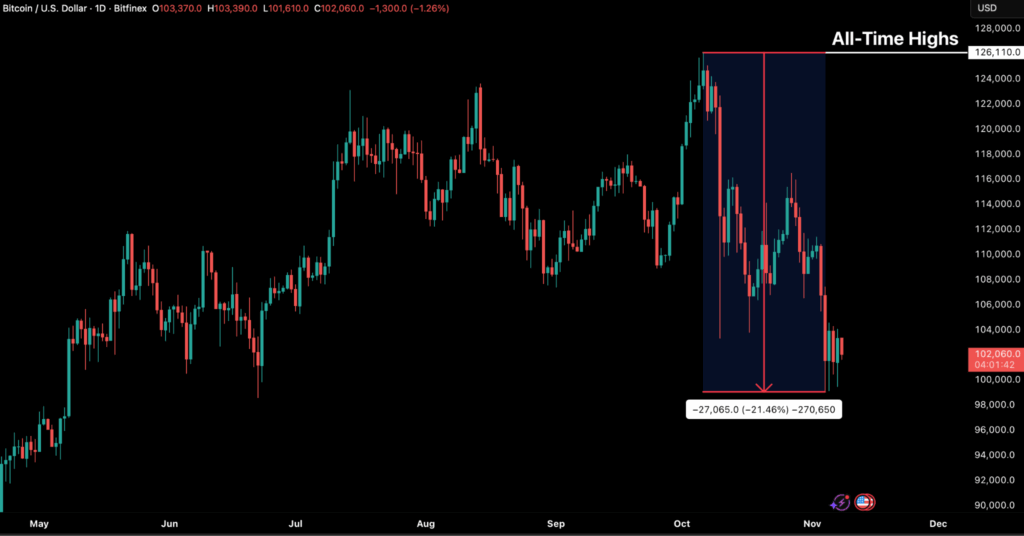

Bitcoin was down by as a lot as 21.46 % from its October all-time excessive final week, briefly dipping beneath the psychological $100,000 mark to a low of $99,045. Such a fall doubtless signifies the institution of a brand new consolidation base somewhat than the onset of a cascading sell-off. Historic market and on-chain information recommend that the present value motion intently mirrors prior mid-cycle corrections, the place structural members stabilise publicity and capital rotates throughout the ecosystem earlier than broader uptrend continuation. The failure to carry above the short-term holders’ (STH) price foundation of $112,500 has led to a managed decline, bringing BTC again beneath that key stage and confirming the anticipated retest of deeper structural helps.

At these ranges, roughly 72 % of BTC provide stays in revenue, close to the decrease finish of the 70–90 % equilibrium band typical of mid-cycle slowdowns. This situation signifies that whereas promoting stress persists, a lot of the speculative extra has already been flushed out. The $88,500 Energetic Traders’ Realised Worth now stands as the following main draw back reference, aligning with previous cycle assist zones the place capitulation traditionally transitioned into re-accumulation. Whereas temporary aid rallies towards the STH price foundation stay doubtless, a sustained restoration will rely on renewed demand inflows from institutional and retail members. Till then, the market is predicted to stay range-bound as volatility compresses and structural positioning resets forward of the following main cycle transfer.

The US financial system is flashing blended indicators the place company borrowing is bouncing again, however hiring is faltering. Within the absence of official information, new private-sector information present that the US labour market is weakening sooner than anticipated, with October’s ADP Nationwide Employment Report recording simply 42,000 new jobs, virtually all from massive companies, whereas small and mid-sized corporations shed employees for the third consecutive month. Shopper confidence has additionally fallen 6 % in November, signalling that households are beginning to really feel the pressure of slower hiring and coverage uncertainty.

The crypto trade is getting into a brand new section of mainstream adoption, pushed by document progress in stablecoins and rising regulatory engagement worldwide. In October 2025, Ethereum-based stablecoins hit an all-time excessive of $2.82 trillion in month-to-month quantity, up 45 % from September, as buyers rotated into dollar-pegged tokens amid market pullbacks and Ethereum’s increasing Layer-2 ecosystem enabled sooner, cheaper transactions. The milestone cements Ethereum’s position as a basis of digital finance, powering remittances, DeFi, and institutional settlements.

Regulators are additionally accelerating efforts to combine blockchain into conventional finance. In Japan, the Monetary Providers Company accredited a stablecoin pilot involving megabanks Mizuho, MUFG, and SMBC, set to start in November 2025, to check regulated digital funds underneath new monetary legal guidelines. In the meantime, in Australia, the Chair of the Australian Securities & Funding Fee (ASIC) Joe Longo urged the nation to embrace tokenisation to modernise its markets, saying a relaunch of the ASIC Innovation Hub and up to date licensing for stablecoins and tokenised securities.