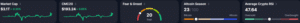

It’s the weekend again, and in today’s crypto update, the broader market remains oversold with the Fear and Greed Index climbing to 20, which is still better than the extreme fear at 13, I suppose, but still represents fear in the market. At the moment, major cryptocurrencies are consolidating, moving sideways, awaiting a catalyst that can help give momentum to their price action.

(Source: CoinMarketCap)

0.74%

, for instance, is currently trading at

, just below its 100-day exponential moving average (EMA) at $91,885. It has recovered from its downward spiral to $80,000, but is yet to break above $91,000 for more gains convincingly.

(Source: TradingView)

And if industry leaders are to be believed, the catalyst for the broader crypto market to rebound from its current sideways movement might be just around the corner. Cathie Wood, CEO of ARK Invest, believes that the Federal Reserve’s (Fed) current policy of quantitative tightening will end on 1 December 2025.

“Quantitative tightening we think will end December 1, that’s a de facto easing,” she said in a November podcast.

CATHIE WOOD SAYS LIQUIDITY RETURNS IN DECEMBER — YOU READY?

Cathie Wood just gave one of the clearest timelines we’ve heard: the liquidity squeeze that crushed risk assets may clear by December 10, right when she expects the Fed to ease.

She reiterated that Ark’s Bitcoin bull… https://t.co/1zahY76vOK pic.twitter.com/f83MC4ixSh

— CryptosRus (@CryptosR_Us) November 25, 2025

Meanwhile, Tom Lee, who leads BitMine Immersion Technologies and is also CIO at Fundstrat Capital, told CNBC that the recent bitcoin sell-off is nearly over. He said, “When we look at those prior corrections, even bitcoin in the last few years, each of them had the recovery, the rise from the low was faster than the drip to the bottom.”

Are markets really set up for a strong rally into year-end?@fundstrat‘s Tom Lee breaks down in his latest @CNBCClosingBell appearance.

Watch the full interview here ⬇️https://t.co/uODV0UXdCT— FS Insight (@fs_insight) November 26, 2025

Lee expects BTC to bounce from current levels and breach $100,000 in December, with a possibility of hitting a new ATH.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Weekend Crypto Update: ETH Fusaka Update Incoming, Year-End Rally Soon?

Since bottoming out at $2,684 on 21 November,

0.74%

has been slowly recovering and is currently trading at

, just above its 50-day EMA at $2980.

The next key level to breach is its 100-day EMA at $3,054. ETH has tried to retest this level before, but has failed to hold above it. If the altcoin king can manage to breach convincingly above this level and maintain, its price can move further towards $$3,618.

(Source: TradingView)

Now, if ETH can manage to further breach this level, it could even open the doorway to challenge $4,200 before the year’s end. One of the core components for this recent uptick in its price action is the much-anticipated Fusaka upgrade scheduled for 3 December 2025.

$ETH is still consolidating around the $3,000 level.

Not much price action due to weekends, but next week could be interesting.

QT is ending on December 1st, Powell's speech is on December 1st, and the Fusaka upgrade is coming on December 3rd.

If Ethereum holds above the… pic.twitter.com/pxgmrOHyah

— Ted (@TedPillows) November 30, 2025

Past upgrades have triggered major rallies; for instance, the May 2025 Pectra upgrade saw ETH rise 55% in just over a month and 168% in about three months. Still, selling pressure has weighed on sentiment. In November, Ethereum ETFs saw $1.42 billion in outflows, more than triple the $403 million recorded in March.

Whales have been offloading. An OG ETH whale offloaded 87,824 ETH worth $270 million, though they still hold over $200 million, showing long-term confidence.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

UK Crypto Tax Update: New DeFi Rules and “No Gain, No Loss” Policy Explained

The United Kingdom has signalled a major change in how it plans to tax DeFi, backing a “no gain, no loss” idea that could end so-called dry tax bills for everyday users.

The government, through HM Revenue & Customs, says it is developing rules to treat many DeFi loans and liquidity-pool moves on a no-gain/no-loss basis. This would delay capital gains tax until there is a real sale or swap, not just when tokens move in and out of a protocol.

🚨 BREAKING: 🇬🇧UK proposes “No-Gain, No-Loss” tax rule for DeFi – deposits into lending or liquidity pools won’t trigger capital gains tax until actual disposal.

Huge win for DeFi users in the UK. 🔥 pic.twitter.com/QDpb2kR8vr

— Real World Asset Watchlist (@RWAwatchlist_) November 27, 2025

The proposal was flagged alongside Wednesday’s Budget on 26 November and set out in a consultation outcome published this week.

Read More Here

Kazakhstan Central Bank Plans To Invest $300M In Crypto

The National Bank of Kazakhstan (NBK) has set its eyes on allocating between $50 million and $300 million from its foreign exchange reserves into crypto-related investments.

A local publication quoted Chairman Timur Suleimenov, stating that the bank will wait for the market conditions to stabilize before undertaking the investment decision.

JUST IN: 🇰🇿 The National Bank of Kazakhstan considering investing up to $300 million in crypto assets – RBC. pic.twitter.com/mlK0xXHlEZ

— Whale Insider (@WhaleInsider) November 30, 2025

Understandable, especially after BTC’s drop from its ATH at $126,000 to 80,000. However, rather than buying the token directly, the NBK intends to invest through ETFs and stocks of crypto companies.

This also aligns with the country’s broader goal of having a state-backed crypto reserve fund worth up to $1 billion.

EXPLORE: 20+ Next Crypto to Explode in 2025

IBIT’s $2.3B Outflow Perfectly Normal: BlackRock Exec

BlackRock’s spot Bitcoin ETF (IBIT) in November witnessed an outflow totaling $2.34 billion, including two major one-day outflows of $523 million and $463 million. Despite the outflows, the company remains confident in the product’s long-term value.

Cristiano Castro, a BlackRock exec, speaking at the Blockchain Conference 2025 in São Paulo, said that such movements are typical for ETFs, especially those dominated by retail investors.

JUST IN: BlackRock’s Cristiano Castro says IBIT’s $2.34B November outflow is normal, reflecting routine retail driven ETF adjustments. pic.twitter.com/Oan6unJpi6

— BNN (@brainsnewsnets) November 30, 2025

Castro noted that earlier demand for IBIT was exceptionally strong, with combined listings in the U.S. and Brazil nearly reaching $100 billion in assets at their peak. He framed the recent outflows as part of a natural cycle, not a structural weakness.

Explore: The 12+ Hottest Crypto Presales to Buy Right Now

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now