Este artículo también está disponible en español.

Dogecoin is currently in a consolidation phase following days of sharp volatility and wild price swings. Since the start of October, the meme coin has been trading within a tight sideways range, leaving some investors concerned about whether the anticipated rally for DOGE will ever materialize. The uncertainty in the market has heightened fears that Dogecoin’s price might stagnate further, as bullish momentum seems to have cooled off.

Related Reading

However, new data from Santiment offers a glimmer of hope for DOGE enthusiasts. The platform’s key metrics show that active addresses on the Dogecoin network have surged to their highest level in eight months. Analysts often consider this spike in network activity as a positive sign, as increased participation and interest can drive price action upward.

As traders keep an eye on these developments, this uptick in active addresses could serve as the catalyst needed for the next significant Dogecoin rally. The question remains: will this trend be enough to reignite the bullish sentiment around DOGE, or will it remain stuck in its current range?

Dogecoin Network Activity Rising

Dogecoin is at the center of intense speculation as investors and analysts debate its future price action. After enduring weeks of volatility and sharp price swings, the meme coin has mirrored the unpredictable nature of the broader crypto market.

Currently consolidating above the key $0.10 level, Dogecoin traders are closely watching for signals that could trigger a rally. Investors are eager for a clear bullish confirmation, but so far, the market remains in a state of uncertainty.

Critical on-chain data offers some hope for Dogecoin enthusiasts despite the lack of immediate upward momentum. According to Santiment data, shared by crypto analyst Ali on X, active Dogecoin addresses recently surged to 133,880, marking the highest level in eight months.

This spike in network activity is often interpreted as a positive sign, suggesting that more traders are engaging with the asset, potentially indicating rising demand.

Related Reading

Higher active addresses generally signal increased transaction participation, which can create upward pressure on prices if sustained. As this trend unfolds, many investors are hopeful that this increased network activity could serve as a catalyst for the next significant DOGE rally. Whether this surge in activity will translate into higher prices or whether DOGE will continue its sideways consolidation remains to be seen.

DOGE Price Action: Key Levels To Watch

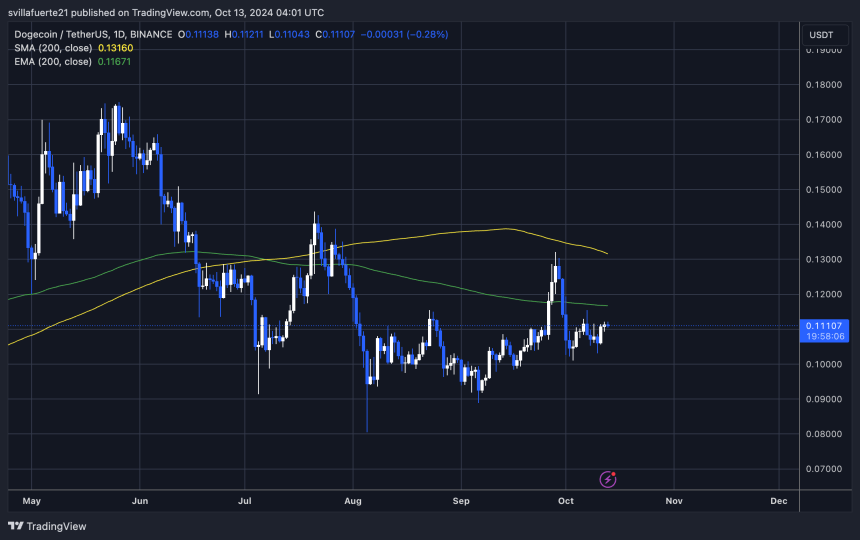

Dogecoin is currently trading at $0.111 after spending the last 12 days in a narrow range between $0.101 and $0.115. This period of consolidation has kept traders on edge, as the price remains just 5% below the daily 200 exponential moving average (EMA), which sits at $0.116. For bulls to initiate a rally and break out of this sideways trend, the price must first surpass this critical resistance level.

However, if DOGE fails to maintain momentum and cannot push above the 1D 200 EMA in the coming weeks, a deeper correction could be on the horizon. In such a scenario, traders should watch for potential support at lower demand levels. The next key support level is around $0.098, with a worst-case scenario declining to $0.088.

Related Reading

The coming days will be crucial for determining whether Dogecoin can break out of its current range or face further downside. Investors are closely monitoring the price action and network activity for signs of a potential rally or a continued slide to lower support levels.

Featured image from Dall-E, chart from TradingView