Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

With Bitcoin precariously recovering above the $100,000 mark and altcoins bleeding momentum, merchants are asking the apparent: Is the crypto bull run over? In response to systematic dealer Adam Bakay (@abetrade), the reply shouldn’t be so clear-cut. In an in depth market breakdown posted June 22, Bakay provided a technically grounded, cautiously defensive evaluation—one which acknowledges geopolitical dangers however stays rooted in positioning and worth construction.

Is The Bitcoin Bull Run Over?

“Trying on the month-to-month and weekly timeframes, we’re nonetheless technically in an uptrend,” Bakay wrote, noting that “no key swing low was damaged, and the 365-day rolling VWAP has been revered in the course of the pullback in April.” Regardless of this, he admits that “the failure to make new all-time highs much like the highest in 2021” is a priority—particularly given the buildup by gamers like BlackRock, which now holds round 3.5% of Bitcoin’s whole provide.

It’s that divergence—between sturdy institutional curiosity and a market struggling to interrupt increased—that has made Bakay extra cautious in current weeks. “That is why I’ve been very defensive and stored most of my trades short-term,” he stated.

Associated Studying

His buying and selling view focuses on two potential technical situations: both a reclaim of the $100,000 help space—“probably if the battle within the Center East doesn’t additional escalate”—or a dip into the $97,000–$95,000 vary, the place sturdy technical help resides within the type of the 200-day transferring common, native worth construction, and the 90-day rolling VWAP.

Nonetheless, Bakay made it clear he’s not shorting the market. “I’m not at the moment contemplating any quick trades resulting from my present positioning,” he emphasised, including that open curiosity is dropping and that we’re beginning to see the “first indicators of clear spot bid curiosity because the April lows.” The choices market, in the meantime, is flashing early warning: the 25-delta danger reversal skew sits round -5, not but at panic ranges, however trending extra destructive.

Crypto Bull Run In Jeopardy

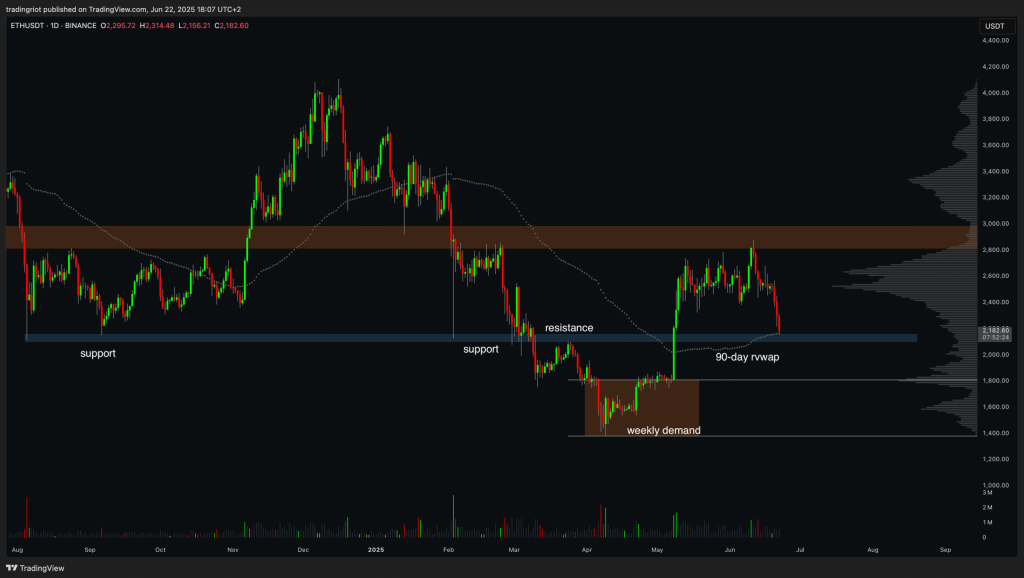

On Ethereum, Bakay was notably blunt. “ETH virtually had its second, however after all needed to change into a disappointment,” he stated. He attributes the failed breakout partially to how rapidly the “DeFi Summer time 2025” narrative went viral. “Individuals are getting too attractive, and market made certain to punish them,” he famous, referencing his personal tweet from just a few days earlier.

Associated Studying

The technical image on ETH doesn’t encourage confidence both. “Throughout important market strikes, like we had firstly of Could, the very last thing you need to see is worth retracing all through that space,” he defined, saying the following significant help lies close to $1,800. On the each day chart, Ethereum is sitting proper at a confluence of help—each the 90-day rolling VWAP and what he calls a “pivotal stage.” Nonetheless, very similar to Bitcoin, Bakay sees Ethereum’s short-term destiny as largely depending on developments within the Center East.

On positioning, ETH additionally reveals indicators of an oversold atmosphere, although Bakay believes excessive volatility in ETH choices has precipitated merchants to make use of spreads as a substitute of outright directional bets. “Positioning is now very clearly pointing in the direction of the potential upside reversal in each perpetual and spot,” he stated.

Altcoins acquired no reprieve. “Altcoins haven’t been having enjoyable for fairly some time,” Bakay wrote, stating that “each time it begins to look higher, it can virtually instantly worsen.” He notes that the anticipated rotation from Bitcoin into altcoins hasn’t materialized, and the true rotation now appears to be into crypto-related equities, which higher replicate the ETF-driven macro commerce.

Even sturdy names like Solana are fading. “SOL has virtually retraced the whole rally from April,” he warned. The important thing stage to look at is $100. “There may be not a lot of a technical help sub-$100,” and if “shit hits the fan,” Bakay would look to bid round that spherical quantity.

Bakay additionally briefly touched on two newer altcoins—Hype and Fartcoin—saying one affords a stable product and the opposite attracts curiosity by way of volatility and liquidity. “Fartcoin would change into engaging if it might reclaim the $1 or $0.50 space. Hype might discover a bounce sub-$30.”

His closing ideas had been pragmatic: “We’re not in simple market situations, with lots of geopolitical uncertainty, and markets might be considerably affected by a single information launch.” Whereas he believes the market could also be “getting too quick in the intervening time,” he stays extremely acutely aware of the likelihood {that a} multi-month correction is already in play. “I don’t suppose there’s a must be a hero and attempt to catch a falling knife,” he concluded. “I’d a lot somewhat await some constructive information and indicators of decrease timeframe reversals.”

In essence, Bakay doesn’t name the highest. However his put up makes one factor clear: this isn’t a marketplace for bravado. It’s a time for restraint, tight danger administration, and respect for volatility—particularly when the bullish case now not has momentum on its aspect.

At press time, BTC traded at $101,847.

Featured picture created with DALL.E, chart from TradingView.com