Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week of Aug. 23:

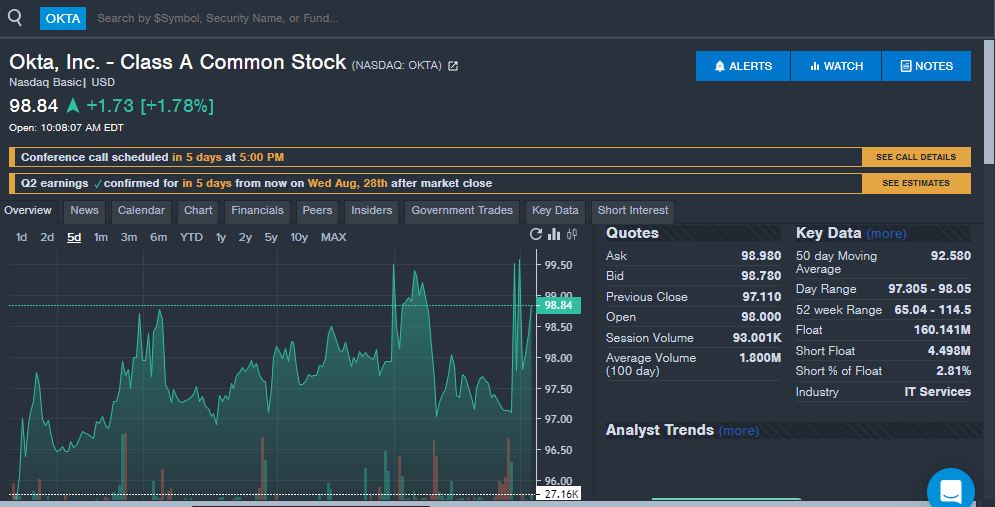

Okta Inc OKTA: The cloud security stock is seeing strong interest from investors ahead of second-quarter financial results. Okta will report Q2 financial results on Aug. 28 after market close.

Analysts expect the company to report earnings per share of 61 cents and revenue of $632.6 million. Both figures represent significant year-over-year increases from 31 cents and $556.0 million respectively. The company has beaten both earnings and revenue estimates from analysts in more than 10 straight quarters. Cloud and security remain two key sectors seeing growth and increased attention from investors.

Okta shares are up 7.3% year-to-date, currently underperforming the broader market.

Faraday Future Intelligent Electric FFIE: The electric vehicle stock has been popular with retail investors over the past year and the stock traded as a penny stock. The company recently completed a reverse stock split lowering the float.

On Monday, the company completed a 1:40 reverse stock split and saw shares soar on the lower float of 12 million shares, with the ticker trending on social media.

Outside of the stock split and retail interest, another catalyst for the company could be coming on Sept. 19 with the company hosting a launch event for its China-U.S. Automotive Bridge Strategy, where it will share details on its second automotive brand. Faraday Future shares soared over 140% on the week, but the stock remains down over 60% year-to-date in 2024.

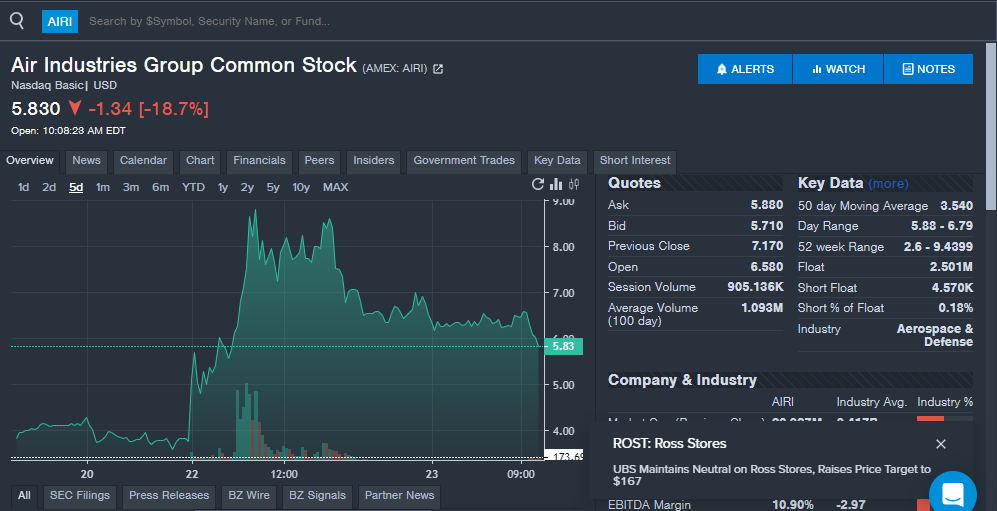

Air Industries Group AIRI: The aerospace company announced a new $110 million, seven-year contract to produce parts for the Geared Turbo-Fan jet engine.

This marks the largest contract in company history for Air Industries and the value is higher than the company’s market capitalization of $24 million. The new contract begins in 2025 and replaces an existing contract set to expire in December 2024. The company said annual sales are expected to increase due to the contract.

“With this single order, our backlog has surged to over $280 million, marking the first time our backlog has exceeded a quarter of a billion dollars,” Air Industries CEO Lou Melluzzo said.

The company recently reported second-quarter financial results with revenue of $13.6 million and earnings per share of 9 cents beating analyst estimates. Air Industries shares are up over 50% in the past five trading days.

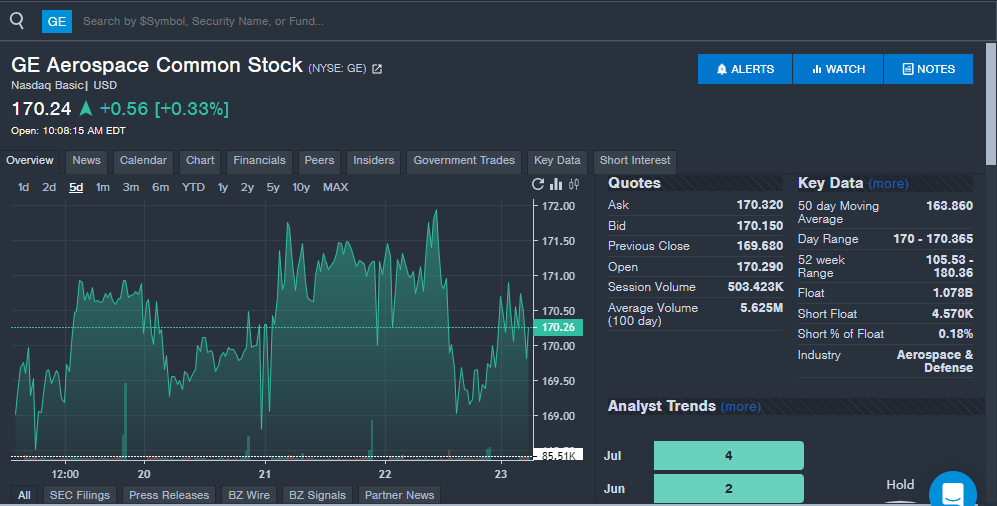

GE Aerospace GE: The aerospace company is seeing increased interest from investors, which could be due to the defense sector becoming a value play or a sector investors are looking at ahead of the 2024 presidential election.

Freedom Capital Markets Chief Global Strategist Jay Woods recently told Benzinga, the defense sector was one that could be a winner no matter who wins the election. Woods named GE Aerospace as a company to watch in the defense sector and a prime example of what splitting up companies can do, with the sum of the parts now worth more than the whole.

GE shares were up slightly on the week and the stock is up over 60% year-to-date in 2024.

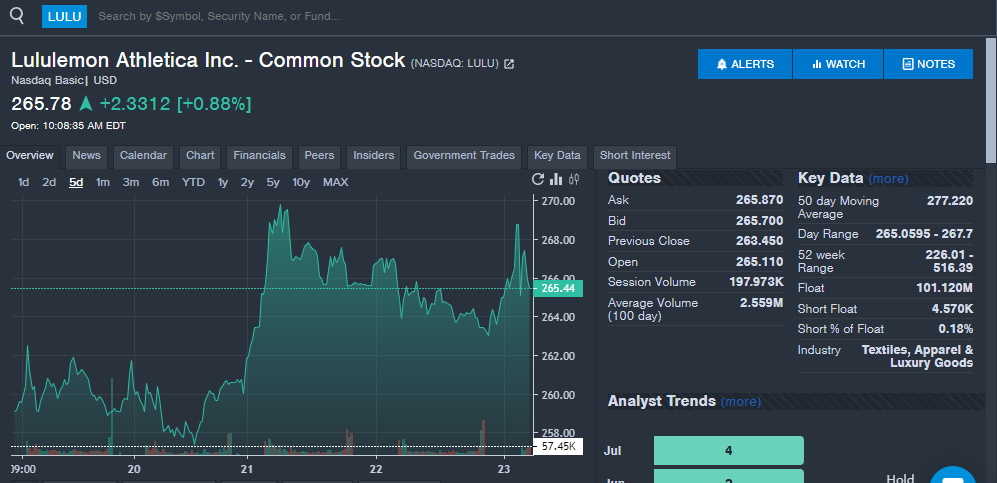

Lululemon Athletica Inc LULU: The apparel company is seeing strong interest from readers ahead of second-quarter financial results.

Lululemon will report second-quarter results on Aug. 29 after market close. Analysts expect the company to report second-quarter revenue of $2.42 billion, up from $2.21 billion in the prior year. Analysts expect the company to post earnings per share of $2.95 for the quarter, up from $2.68 in the prior year.

Lululemon has beaten analyst estimates for revenue in nine straight quarters and earnings per share in more than 10 straight quarters.

Shares of Lululemon rose over 1.5% on the week, but remain down over 40% year-to-date in 2024.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.