ABM Industries Incorporated ABM will release earnings results for its third quarter, before the opening bell on Friday, Sept. 6.

Analysts expect the New York-based company to report quarterly earnings at 86 cents per share, up from 79 cents per share in the year-ago period. ABM is projected to post revenue of $2.04 billion, according to data from Benzinga Pro.

On June 24, ABM said it has acquired Quality Uptime Services, Inc, a prominent player in the critical power services industry for an all-cash purchase price of $119 million..

ABM shares gained 0.2% to close at $56.10 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

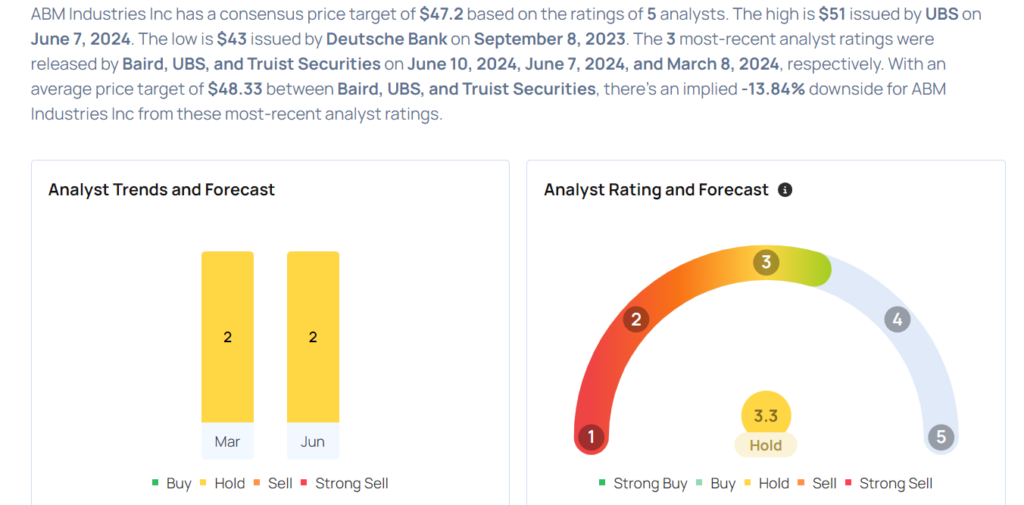

- Baird analyst Andrew Wittmann maintained a Neutral rating and raised the price target from $48 to $49 on June 10. This analyst has an accuracy rate of 78%.

- UBS analyst Joshua Chan maintained a Neutral rating and boosted the price target from $45 to $51 on June 7. This analyst has an accuracy rate of 74%.

- Truist Securities analyst Jasper Bibb maintained a Hold rating and cut the price target from $53 to $45 on March 8. This analyst has an accuracy rate of 68%.

- Keybanc analyst Sean Eastman maintained an Overweight rating and slashed the price target from $51 to $48 on Sept. 11, 2023. This analyst has an accuracy rate of 86%.

- Deutsche Bank analyst Faiza Alwy downgraded the stock from Buy to Hold and cut the price target from $65 to $43 on Sept. 8, 2023. This analyst has an accuracy rate of 62%.

Considering buying ABM stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.