The Lovesac Company LOVE will release earnings results for its second quarter, before the opening bell on Thursday, Sept. 12.

Analysts expect the Stamford, Connecticut-based company to report a quarterly loss at 44 cents per share, versus a year-ago loss of 4 cents per share. Lovesac projects to report quarterly revenue of $157 million for the quarter, according to data from Benzinga Pro.

On July 31, Lovesac said it has entered into a five-year extension of its revolving credit facility by $10 million and that its board of directors authorized a share repurchase program up to $40 million.

Lovesac shares rose 0.5% to close at $21.02 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

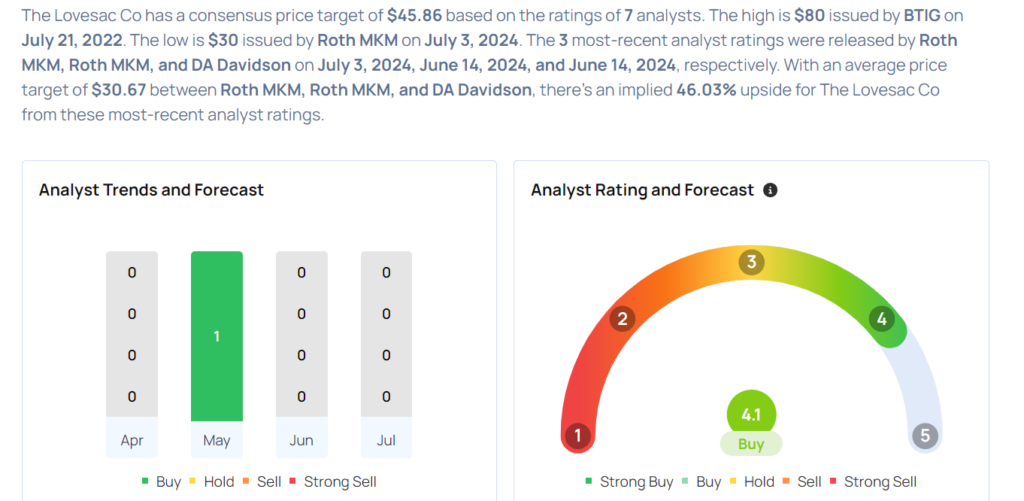

- DA Davidson analyst Tom Forte maintained a Buy rating and raised the price target from $24 to $32 on June 14. This analyst has an accuracy rate of 78%.

- Canaccord Genuity analyst Maria Ripps maintained a Buy rating with a price target of $36 on June 14. This analyst has an accuracy rate of 72%.

- Oppenheimer analyst Brian Nagel maintained an Outperform rating and lowered the price target from $60 to $35 on May 1. This analyst has an accuracy rate of 71%.

Considering buying LOVE stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.