Este artículo también está disponible en español.

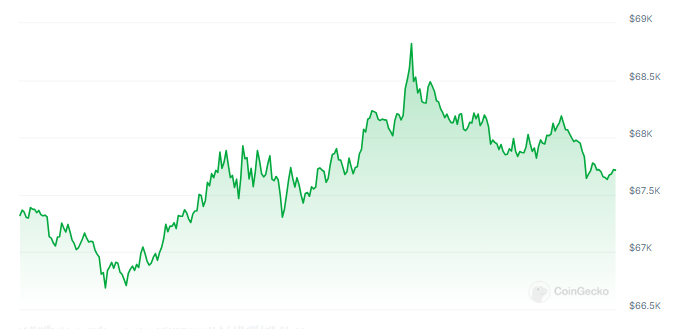

Microsoft is preparing for a critical shareholder meeting on December 10, during which the future of Bitcoin as a potential investment will be a heated topic. At present, Bitcoin is trading at approximately $68,115, which represents an increase of approximately 1.22%.

The rise in interest aligns with constant debates around the cryptocurrency as an inflation hedge, which some Microsoft investors find appealing.

Related Reading

Microsoft’s Position On Bitcoin

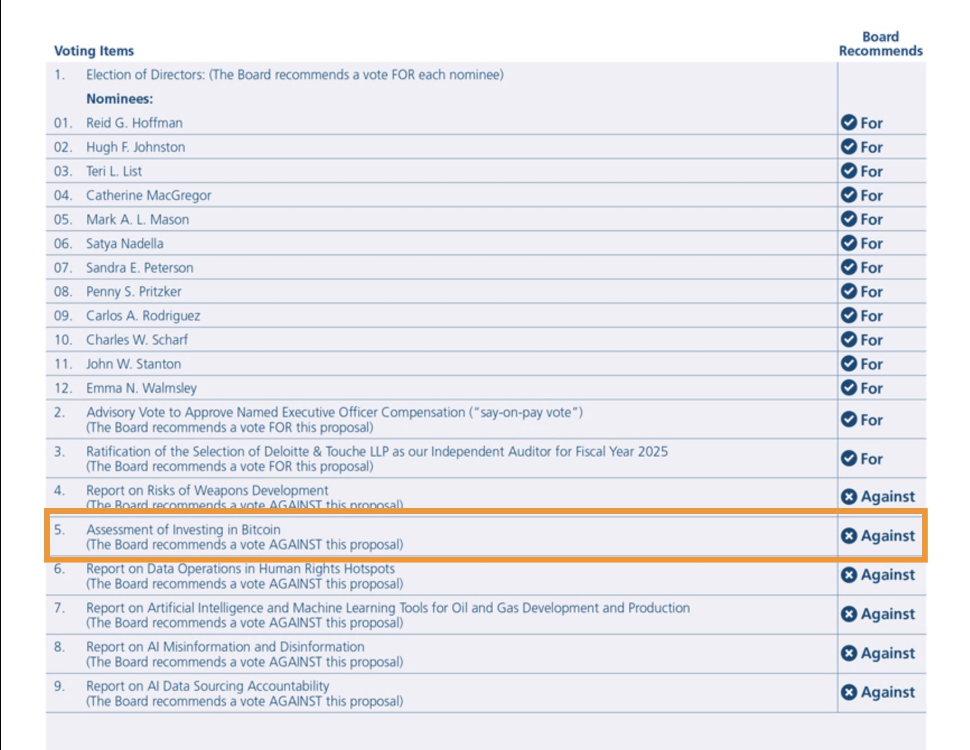

Microsoft revealed in a recent application to the US Securities and Exchange Commission that it will propose evaluating Bitcoin investment during the forthcoming conference.

The National Center for Public Policy Research (NCPPR) says that Bitcoin has done better than traditional investments and could be a good way to protect against inflation.

JUST IN: Per an SEC filing, Microsoft will have a proposed board resolution for an “Assessment of Investing in Bitcoin”.

The board is recommending that shareholders vote AGAINST the proposal. pic.twitter.com/0WveygitH9

— TFTC (@TFTC21) October 24, 2024

Microsoft’s board, on the other hand, wants shareholders to vote against this plan because the company has already looked at a wide range of investable assets, including cryptocurrencies.

According to a spokesperson for the company:

“Volatility is one of the important aspects for all the investments in cryptocurrencies for corporate treasury”

This emphasizes the careful strategy that Microsoft has adopted as far as the management of its corporate treasury is concerned as well as for the benefit of enhancing the shareholders value for the long term.

The board is of the opinion that the requested public appraisal is unnecessary, as they already monitor trends and developments in the cryptocurrency sector.

Big-Wig Stockholders

Microsoft’s major shareholders include a number of major institutional investors, such as Vanguard, BlackRock, and State Street. These organizations own a large percentage of the company and have considerable power to affect its policy direction.

Although some shareholders are advocating for Bitcoin investments, others may be more in line with the board’s cautious stance.

It is important to note that BlackRock has been actively increasing its Bitcoin holdings through its ETFs. BlackRock’s iShares Bitcoin Trust ETF has registered inflows to the tune of over $317 million in a 24-hour timeframe, according to recent reports.

This trend implies that there is an increasing institutional interest in Bitcoin, despite Microsoft’s reluctance to implement comparable measures.

The Road Ahead

As the December conference gets ready, the debate about Bitcoin’s importance in Microsoft’s investment plan gets more intense.

The NCPPR argues that businesses should commit at least 1% of their whole assets to Bitcoin to help to reduce inflation risks. Despite this project, Microsoft insists that its present corporate treasury distribution policies are sufficient.

Related Reading

Bitcoin has experienced a nearly twofold increase in value in the past year and has recorded a remarkable 414% increase over the past five years. Although Microsoft may not be completely prepared to invest in cryptocurrency investments at this time, the increasing interest from institutional investors such as BlackRock suggests that the discourse surrounding Bitcoin is far from over.

Microsoft’s upcoming shareholder meeting will be the focus of all attention, and it is uncertain whether the tech giant will alter its position on cryptocurrencies or maintain its commitment to stability in its investment strategy.

Featured image created with Dall.E, chart from TradingView