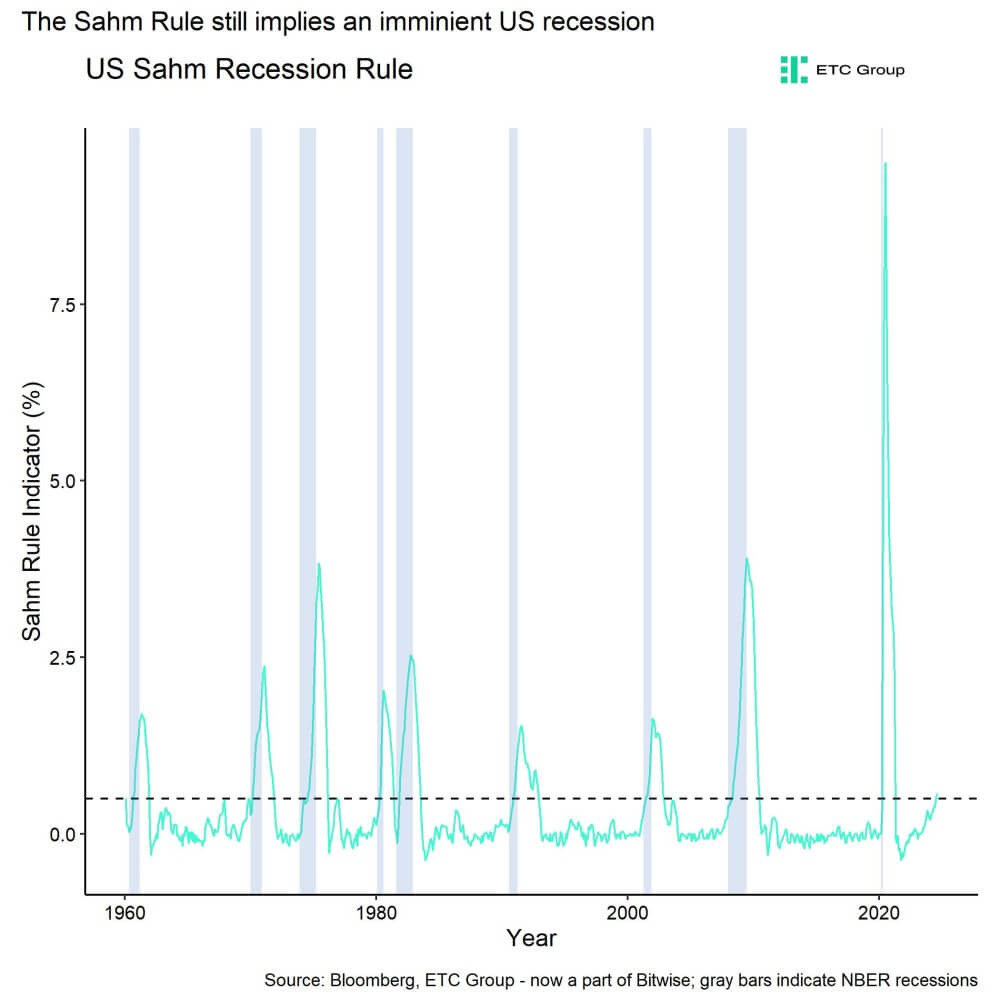

The Sahm Rule, a key recession indicator, continues to signal an elevated risk of an economic downturn in the United States, adding to bearish sentiment in crypto markets already grappling with negative on-chain trends.

According to a recent analysis by ETC Group (now a part of Bitwise), the Sahm Rule remains triggered, implying an imminent US recession. Created by former Federal Reserve economist Claudia Sahm, this indicator flags the onset of a recession when the three-month moving average unemployment rate rises 0.50 percentage points or more relative to its low during the previous 12 months.

The latest data reveals the Sahm recession indicator stood at 0.53 in July 2024, slightly up from the previous month. This sustained elevation above the required threshold suggests that recessionary pressures persist despite the resilience shown by the US economy so far.

The ongoing recession risk comes as crypto markets face their challenges. ETC Group’s analysis indicates that major Bitcoin on-chain metrics have continued negatively trending. Net selling volumes across Bitcoin spot exchanges totaled around -$606 million over the past week, though the selling pace has gradually declined throughout the start of September.

Additionally, Bitcoin whales transferred 9,477 BTC to exchanges on a net basis last week, contributing to increased selling pressure. As a result, Bitcoin exchange balances have risen over the past week.

The bearish on-chain data aligns with broader negative sentiment in crypto markets. ETC Group’s in-house “Cryptoasset Sentiment Index” continues to signal bearish sentiment, with only 4 out of 15 indicators above their short-term trend.

However, some analysts see the potential for a shift in market conditions. ETC Group suggests that the combination of macro and crypto sentiment capitulation in early August may have marked a significant tactical bottom for Bitcoin, potentially signaling the start of a renewed bull run. This view is based partly on expectations of looser monetary policy from the Federal Reserve, which could provide a favorable tailwind for cryptocurrencies in the coming months.

As the market navigates these conflicting signals, recessionary risks and bearish on-chain trends persist, and the potential for monetary policy shifts and oversold conditions could set the stage for a market reversal.